SurePayroll’s secure connection can be used to view employee payrolls and upload HR documents. Additionally, employees can use it to view W-2 and T-4 information.

Or

SurePayroll Login handles setup, data management, and payroll seamlessly. Several versions are available for a wide range of industries, making it an excellent choice for most small businesses. With SurePayroll, which is entirely cloud-based, you can quickly enter the payment information you need and take care of the rest, including unlimited pay stubs and multiple payment rates, as well as extended tax returns and payment submissions.

SurePayroll supports direct deposit at no additional cost, with direct deposit available to 1,099 employees and contractors. In addition to handling all tax forms, SurePayroll handles all new employee reporting requirements for your company, another thing you can take from above.

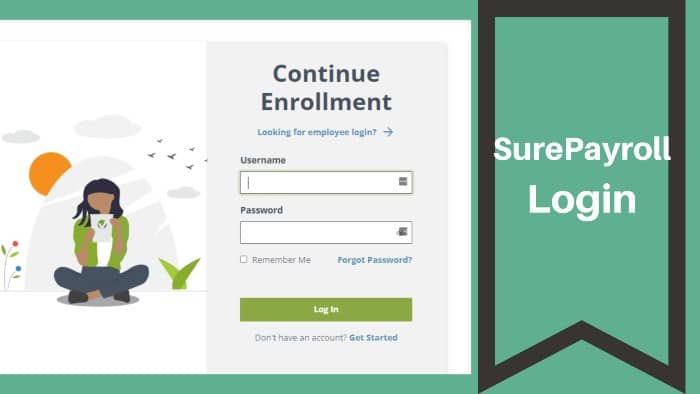

Secure SurePayroll Login Guide

- First, go to your browser and type https://secure.surepayroll.com/SPF/Login/Auth.aspx or click here to open your SurePayroll login account at www.surepayroll.com.

- You will soon be redirected to the SurePayroll payment slip login portal.

- Enter your valid “Username” provided by SurePayroll Company below.

- Now click the “Next” button, and you can now access your SurePayroll PayStubs account.

SurePayroll Pay Stub Portal – Terms

- Access to the official SurePayroll PayStubs employee portal website at www.surepayroll.com.

- Laptop or PC or smartphone or tablet.

- Internet browser that adapts to open the portal.

- Authentic credentials for proof of payment, such as self-service username and password B. SurePayroll.

- Reliable internet connection.

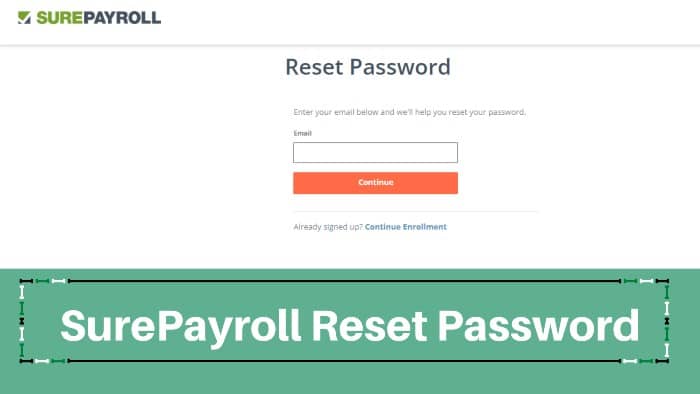

How To Reset My SurePayroll Login Password?

If you are an employee, contact your employer to reset your password at www.surepayroll.com. If you are an employer or accountant, click Forgot your password? under your login screen on your portal.

- If you don’t remember your password, click on “Forgot your username/password?”. Shortcut.

- Now enter your username and click “Submit.”

- Finally, you can reset your password after completing the steps.

- If you forgot your username, you could contact customer service.

Thanks for keeping this post until the end. This article will surely help you get SurePayroll Paystub Login and other required details. If you have any difficulties or recommendations, please use the comment box below.

Features Of SurePayroll

Payroll can be overwhelming for new business owners, but SurePayroll offers many specifically designed for small business owners.

Mobile functionality

In addition to full cloud access, SurePayroll includes a mobile app for iOS and Android devices so you can take care of payroll from anywhere when you need to. SurePayroll allows you to make unlimited payrolls, with same-day and next-day payroll options.

Payroll step by step

The Sure Payroll Accountant Login payroll entry screen is designed to be efficient, so you can simply click the box next to each employee and enter their hours for the pay period. The exact process is followed for salaried employees, although you only need to check the box next to your name to process the payroll. There is also the option of an additional payment method if you want to add a bonus or commission payment, and one-time deductions can be added.

Automatic payment

Still, worried about late payment or even missing a payment date? Then automatic payroll settlement is for you. With computerized payroll, you can enter predetermined hours or pay amounts to your employees, and SurePayroll will take care of that and do the rest. SurePayroll will send you a reminder that the payroll will be processed soon and give you a deadline to make any changes.

Calculate payroll tax

The main reason corporations and small businesses turn to payroll services are that they are not comfortable calculating and filling out all the necessary payroll tax forms, including forms 940, 941, and 943.

Process year-end forms and reports

In addition to filing quarterly tax returns, SurePayroll also processes W-2s for your employees and 1099s for contract employees that you paid during the year.

Pay 1099 contractors

Small businesses today hire contractors as often as they hire employees.

Self-service for employees

SurePayroll provides a convenient and secure online portal for your employees, giving them access to payroll-related information such as current and historical pay stubs and W-2 forms.

Variety of reports

SurePayroll offers a good selection of payroll reports, including an employee detail report, new hire report, check the log, and deduction report.

Integration with time and attendance software and accounting applications

SurePayroll integrates with many counting apps, including SpringAhead, Homebase, and Inception.

Benefits Offered By SurePayroll

With SurePayroll, you get unbeatable benefits like:

- Run payroll in seconds anywhere you have internet access, even from your mobile device.

- Reduce trips to the bank and easily access payslips.

- Don’t worry about payroll tax compliance – SurePayroll guarantees accuracy.

- Rest assured that help is available over the phone and online.

- Comply with legal regulations and download updated business documents for your office for free.

- Click to access time-saving technology and the ability to customize employee hours and pay rates for each pay period.

- Direct deposit and employee access to online pay stubs

- Payment of federal, state, and local taxes for full service and _ling

- Unlimited support from US payroll experts.

- Automated reports on new hires and access to labor law posters, business forms, and HR guides

- SurePayroll’s services provide businesses with a secure way to process their payroll over the Internet.

- SurePayroll’s unique and straightforward service delivers payslips directly to employees over the Internet. The result is unparalleled savings in time and money.

- SurePayroll is faster, simpler, and costs half the internal processing costs.

Cost And Usage Of SurePayroll Login

SurePayroll offers two plans: Self Service, which costs $19.99/month plus a $4 per employee fee, and Full Service, which costs $29.99/month and includes a $5 check per employee. Employee. The full-service plan includes all the features of the self-service program, plus complete tax returns and a two-day payroll turnaround time.

Who is Sure Payroll Accountant Login for?

- Sure Payroll Accountant Login is explicitly designed for small business owners, with a particular version available for paying babysitters or other home workers.

- Ideal for small businesses, SurePayroll offers both a self-service and full-service plan, with additional options also available.

- With SurePayroll, which is entirely cloud-based, you can quickly enter the payment information you need and take care of the rest, including unlimited pay stubs and multiple payment rates, as well as extended tax returns and payment submissions.

About SurePayroll

SurePayroll is flexible and has a polished, professional interface, but the service is a step or two behind Editors’ Choice winners Gusto and Rippling. Its user experiences, customization options, employee portals, and depth of functionality are superior to any other site we have reviewed.

SurePayroll has improved areas like onboarding, navigation, help, and of course, COVID-19 and compliance features. Quick Launcher centralizes help tools, and additional UI changes make navigation easier. Now SurePayroll also integrates with Zoho Books. It was acquired by Paychex a few years ago, and Paychex continues to support many of its functions, including compliance.

Once you’ve set up your SurePayroll login, the website will take you to the central setup center, which is divided into five sections. At this point, you’ve already provided the information for the About You tab (name, email, and phone), but you can edit it if needed. Click on the next tab titled Business Information to provide your legal name, company type, etc. Next, you define your payroll schedule (SurePayroll is exceptionally flexible here) and the first pay cycle.

SurePayroll offers peace of mind through a combination of innovative, cutting-edge technology and personalized support from an award-winning customer service team in the United States. We will always strive to serve our customers by taking their payment worries away. In addition, SurePayroll offers efficient solutions for managing 401(k) plans, health insurance, employee compensation, employee screening, and more.

Mobile App For Sure Payroll

It is a mobile application developed by SurePayroll Inc. If you have a SurePayroll account, then this app is free for you. The app is accessible on all types of Android phones and Apple devices.

SurePayroll for Employees allows you to securely access your payroll information from your iPhone, iPad or iPod touch mobile device. Now employees can view their paychecks anytime, anywhere.

Features of Sure Payroll

- View paycheck details, including income, taxes, deductions, and year-to-date totals

- Track your used, available, and earned leave, personal and medical leave

- View multiple paychecks distributed in the same pay period

- View your salary rate and contribution rates for retirement deductions

- Check the accuracy of your contact information in your employer’s file

- Access past tickets

- Available for hourly, salaried, and 1099 employees

- Uses the same username and password as your existing MyPayday online payroll account

- Information available 24/7

| Official Name | SurePayroll |

|---|---|

| Portal Type | Login |

| Portal Service | Online Payroll Services |

| Country | USA |

| Managed By | SurePayroll |

Customer Support Sure Payroll

The support team will be ready to answer your questions over the phone or via the chat option on the right side of your screen. After hours, you can send a message using the chat option, and the support team will get back to you the next day.

Working with Sure Payroll support

Live customer support is available on SurePayroll, with support also available in the evenings and on Saturdays. Help is available via a toll-free hotline or by email.

All new SurePayroll customers are formally assigned an account manager who can help with the initial payroll setup that answers any questions that may arise.

In addition to product support, SurePayroll provides easy access to product help resources anywhere in the application, including the FAQ page.

You can also check out the Payroll Terminology page, Payroll by State, and Payroll and Tax Calculators. The SurePayroll blog provides valuable information on the payroll in general and SurePayroll features and benefits.

Frequently Asked Questions

How To Download My www.surepayroll.com PayStub?

By using the official SurePayroll Paystub login portal, you can regularly check your payment information and download and print your SurePayroll statement.

What is a One-Day Debit? Can I do that on my account?

An overnight Debit is a tool that allows a customer to process ACH and post transactions the next day if the Sure Payroll Employee Login is processed within the Overnight Debit schedule. While “regular” ACH is often the preferred solution for payroll processing, overnight debit is preferred for emergency payroll.

Particular policies apply to overnight debit features and exceptions. You may contact customer service to learn more about your eligibility for overnight debit payment or other flexible payroll options.

When can I submit a Day payroll online?

You have the option of submitting a daily direct debit or payment receipt online by the 4:00 am CST cut-off time. Any transfer is subject to SurePayroll approval and must have funds available. You may be asked to provide bank details to verify available funds. If you have any additional questions or concerns about one-day payroll/debits, please contact Customer Service.

Conclusion

The interface and functionality of Sure Payroll are almost identical to that of last year’s review. Compared with Gusto’s lighter, more state-of-the-art visuals, it has a serious, professional look (which is not a criticism; some might prefer this approach). Overall, it’s been a little easier to learn how SurePayroll works than Gusto, but overall, it’s a little more complex to use. The former’s menu-based navigation system more skillfully points you in the right direction.

A good feature of Sure Payroll Employee Login is the Dashboard, which is among the best among this group of websites. Towards the left-hand corner, you will find the most important data on this page: your current payroll. You will find here the date of the recent pay period start, end, and check date; the deadline (this is the most prominent date/time on the page) and a big orange button that says Continue (or Begin) Payroll.